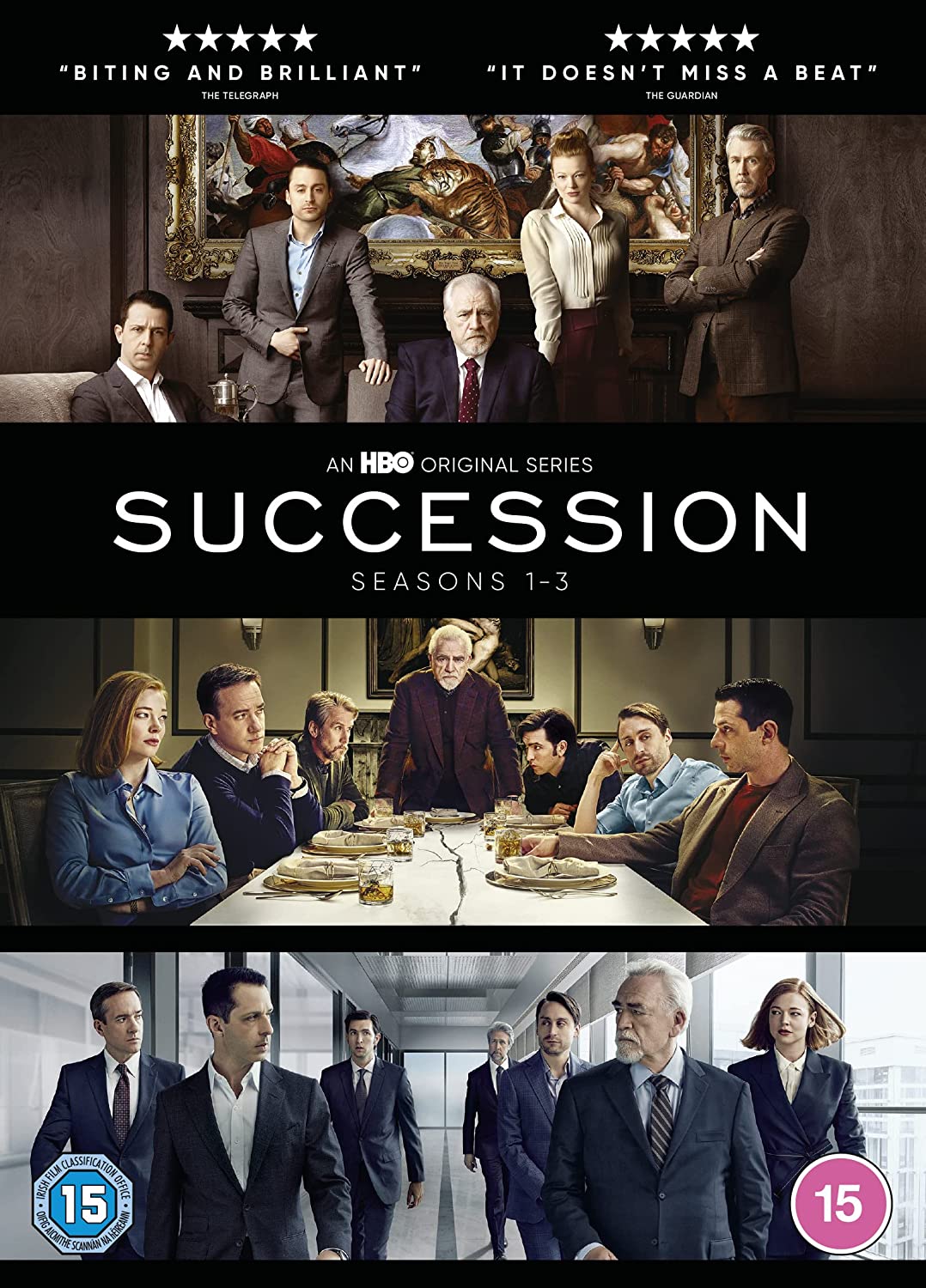

When Logan Roy, head of the Roy family and CEO of Waystar Royco, collapsed from a sudden and serious stroke on HBO’s hit show – Succession – his family and business followed into disarray.

Without any clear succession plan, the family power struggle boiled over into the public realm and both the share price and reputation of Waystar Royco spiralled downwards.

Since the onset of the Covid-19 pandemic, more and more heads of families are realising that unexpectedly falling seriously ill and being incapacitated is a very real possibility. However, family offices, whether they are a single family or a multi-family office, don’t need to follow in the footsteps of the Roy family’s drama or uncertain future if they get their affairs in order before the crisis happens.

Avoiding a succession crisis

The generational wealth transfer has been fast approaching for a number of years, but with it finally upon us, family offices need to think about structuring the family business, investments and office. This applies not only in terms of well thought-out legal holding structures, but also to including the younger generation in the governance of such vehicles, and ensuring they have enough time to get up to speed with the inner workings of the family office.

Perhaps the biggest mistake that Logan Roy made wasn’t necessarily the legal holding structure, but rather failing to agree upon a succession plan with his family. According to Wealth X and IQ-EQ, as much as $15.4 trillion of wealth from individuals with a net worth of $5 million or more will be transferred from the older generations to the younger generations over the next five years.

Structuring a family office and setting it up to thrive once assets and control have been passed to the younger generation is increasingly complex. Globalisation has meant that families have both family members and assets (such as real estate, digital assets and bank accounts) spread out across the globe. This cross-border complexity in turn brings a range of risks that need to be addressed and mitigated, including succession laws, marital regimes, privacy concerns, tax rules and other regulatory and compliance obligations.

To deal with these complexities, family offices are turning towards specialised outsourced providers who can provide the family with a succinct overview of their assets and its performance regardless of where the family members and/or assets are based. And jurisdictions such as Jersey are well adapted to providing for global family offices.

In Jersey, family offices can either be hosted by a regulated trust company business (TCB), or establish their own presence in the island. If they choose to be hosted by a TCB, then the TCB’s staff will set up the structure of the family office, which will not need its own employees or a physical presence.

Adapting to the future

Although Logan Roy refuses to accept Kendall’s suggestions for new business ventures as the season progresses, family offices have to adapt to the future, and be in a position to have a foundation in which the next generation may succeed. The younger generation often has different priorities than the older generation, such as impact and ESG investing, digital assets, and co- or direct investing, which their parents may not be as focused on.

As decision-making power is handed over to the younger generations, money allocated to impact investing will continue to grow. According to UBS’s Global Family Office Report, 56% of family offices are already investing in impact or ESG assets. This is most notable in Western Europe, where 72% of families are already investing in sustainable investments, while only 26% of families in the U.S. are. Sustainable investments as an investment tactic are being primarily driven by the positive impact they have on society (62%) with roughly half (49%) seeing it as the main way to invest in the future.

In addition to sustainable investing, the hype around digital assets – from NFTs such as the Bored Ape Yacht Club, to Bitcoin – is not going away anytime soon. While most family offices are testing the waters with some exposure to the world of crypto, increased regulation in this area will only increase interest. The world of digital assets is still muddled, and family offices need to understand how they verify source of wealth pertaining to digital assets, and how they can be structured within a trust and/or other holding vehicles.

Compared to traditional money managers such as asset managers or private equity fund managers, family offices have much more flexibility in what they invest in, how they invest, and the investment’s horizon. Jersey’s modern and sophisticated legal framework matches the flexibility that family offices need, providing a plethora of structuring options such as trusts, companies, foundations and limited partnerships. Each of these structures can be configured in several different ways to exactly match each family’s needs.

Given the increasing complexity and rise of wealth globally, family offices are more likely to bring the investing decisions of a family office in house, but outsource the administration and execution.

The story continues

Besides watching Succession for entertainment purposes, family offices in Jersey should take warning from the show to begin the generational wealth transfer process and avoid any internal succession crises. Looking ahead, family office wealth and the associated complexities will continue to increase and planning for succession far in advance of any health issues will help prevent the issues the Roy family is facing. After all, it’s much easier to build a house when the skies are clear than when faced with a storm.

Written by Adam Garwood, Director, Private Wealth at IQ-EQ in Jersey.