Barclays has launched a new feature within its mobile banking app giving customers in the Channel Islands the ability to ‘turn off’ spending with certain types of retailers.

Barclays developed the new tool with customers in vulnerable circumstances in mind. However, the mobile banking app feature will help all customers take greater control over where their money can be spent, as well as making them less vulnerable to fraud and scams.

Barclays is the first UK high street bank to offer the feature, which is available on both the UK mobile banking app and the Overseas mobile banking app,

Working with a range of UK-based advisors such as the Money Advice Trust and building on published evidence from organisations such as the Money and Mental Health Policy Institute, Barclays identified a group of customers who would particularly benefit from being able to decide how and where their money is spent. These include those with mental health issues, addictions, and those who rely on carers or a guardian to handle their finances.

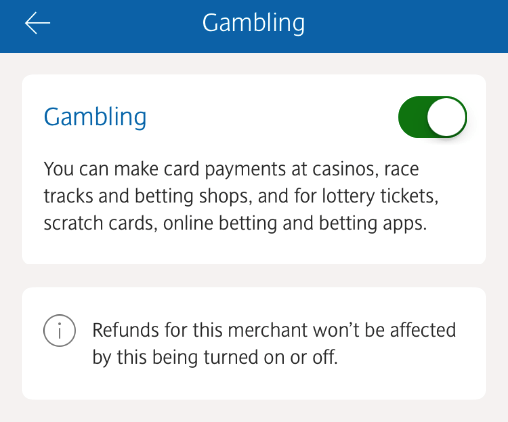

A simple button within the Barclays mobile banking app now allows the customer to choose which types of retailers they are able to spend with, meaning any attempted payments that fall within the ‘turned off’ category will be automatically declined.

Barclays identified five core retailer groups which customers can control. These groups have been selected based on research by the bank into the areas that customers would most like to manage, as well as consultation with advisors.

The retailer categories are:

Groceries and supermarkets

Restaurants, takeaways, pubs and bars

Petrol and diesel

Gambling (to include gambling websites and betting shops)

Premium rate websites and phone lines (to include: 0870 numbers, mostly used for sales calls; 09 numbers, used for live entertainment, competitions, TV voting and adult lines; and 118 numbers, including directory enquiries. This blocks the purchases made from these services, not the numbers themselves).

Justine Gaudion, Head of Local Markets for Barclays in Guernsey, said: “We are always looking for new ways to support our customers and make it easier for them to manage their finances.

“This new control feature is the latest new service that we have introduced in the Barclays Mobile Banking app that aims to give all of our customers a better way to manage their money in a simple, secure and effective way.”

Martin Lewis, MoneySavingExpert, Founder and Chair of the Money and Mental Health Policy Institute, said: “Mental health and debt is a marriage made in hell. Many with mental health issues struggle to control their spending – whether through gambling, shopping or premium phone lines – and I commonly hear from people with thousands of pounds of debt as a result.

“This is one reason why I set up the Money and Mental Health Policy Institute charity – and its detailed research shows the power of giving people more options for control tools that can add friction to this type of spending. I want to applaud Barclays for being the first major bank to sit up, take note and act. I believe it will make a real difference to people’s lives and I hope the other banks will follow suit.”

Chris Fitch, Vulnerability Lead at the Money Advice Trust, said: “Technology that meets everyday banking needs, while recognising the challenges many of us face in our lives, is the way forward. Giving everyone more control is the key to achieving this – whether this is someone who wants to be less vulnerable to fraud, or a customer who is trying to take charge of their gambling.”

Marc Etches, Chief Executive of GambleAware, said: “GambleAware welcomes this initiative by Barclays, which we hope will encourage other banks to do the same. There are 340,000 problem gamblers in Britain and a further 1.7 million at risk, and initiatives like this can play an important role in helping to reduce gambling-related harms. There are no limits to stakes and prizes for online gambling, and credit cards are allowed so it is important to make it easier for people to control their spending.”