Increasing levels of activity from venture and private equity funds over the last twelve months has continued into 2021 with significant interest from new managers looking to launch their first fund Guernsey, according to Ogier’s funds team in Guernsey.

The team recently acted as lead counsel to Reference Capital SA, a new manager in Guernsey, on the formation and registration of Reference Seed Fund I LP in Guernsey as a private investment fund (PIF) and on its initial and subsequent close.

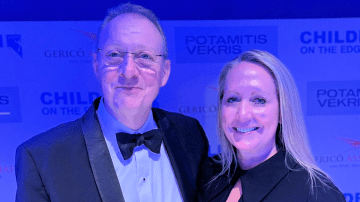

Ogier Partner, Tim Clipstone, Managing Associate Richard Doyle and Legal Assistant James Dickinson formed the team that advised Reference on all legal and regulatory aspects of the fund’s launch as a PIF.

Tim Clipstone (shown in the main picture) explained to Channel Eye: “It has been great to work with Reference as a new manager in Guernsey and we have been delighted to advise on the successful launch of Reference Seed Fund I LP.”

Richard Doyle said: “We’ve advised on the closing of a number of technology focused funds structured as PIFs in Quarter 1 this year, both in the venture and private equity sectors and with underlying technology portfolios as diverse as healthcare, fintech, e-commerce and human resources. We anticipate the appeal of the Guernsey PIF as a flexible fund option for investing in the technology sector will continue to grow.”

Reference Fund is a fund of funds structured as a Guernsey limited partnership which targets investments with a global coverage (China, Israel, Europe and USA) in Seed stage technology focussed funds.