Jersey’s funds industry is maintaining its upward trajectory – but evolution in the market, regulatory change and competition means that the Jersey Funds Association is busier than ever, according to committee members speaking at the JFA’s recent Chairman’s Update event.

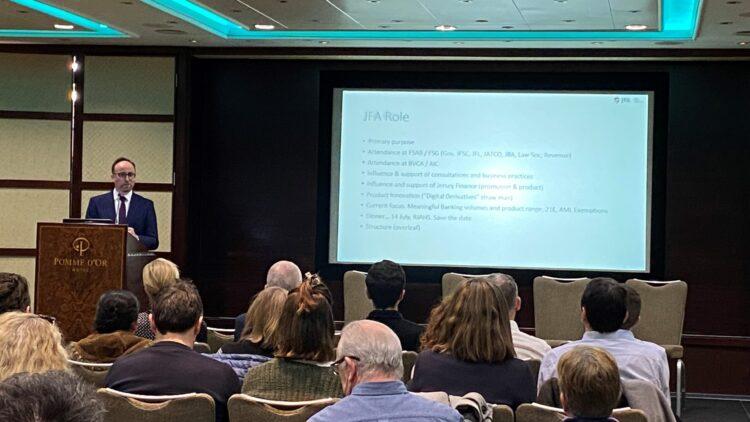

Held at the Pomme d’Or recently, the event saw Chairman Michael Johnson (pictured) and Vice Chairman Joel Hernandez assess the current landscape and set out some of the priorities for the JFA over the coming year, whilst sub-committee heads also took part in a Q&A session highlighting some of the trends, challenges and opportunities on the horizon.

Pointing to the fact that the value of assets serviced in Jersey rose to new record levels of more than £0.5trn in 2022, Michael also emphasised how important it was to be alive to the potential for change in the wider landscape: “Our figures continue to illustrate an upward trend, but it’s really important we stay ahead of the curve and anticipate regulatory change and shifts in investor behaviour to maintain our attractive ecosystem for alternative funds.

“Speed to market, cost-effectiveness and service quality are absolutely crucial in our segment of the alternatives market and we are fully focused not only on safeguarding our position but on enhancing our proposition in those areas. On the ESG front, for example, the key is to establish a robust framework but without creating hurdles, whilst on the innovation front we see opportunities to build up a track record in blockchain, tokenisation and digital assets.”

Joel added: “From a legal and technical perspective, it has never been busier in terms of the need to respond to consultations and international and domestic regulatory change – such as looking at our AML/CFT frameworks, enhancing our range of fund structures and regimes, and ensuring we keep the cost of doing business with Jersey competitive. We are fortunate in the JFA to have broad and diverse expertise through our membership to support our efforts in these areas.”

![An evening with ‘Bank of Dave’ Fishwick at the GCC Gala Dinner [sold out]](https://channeleye.media/wp-content/uploads/2023/03/dave-fishwick-giving-speech-scaled-e1679052435775-75x75.jpg)