More than two-thirds (68%) of CEOs from the world’s largest companies say that they plan to take on a major investment in data and technology over the next 12 months, while 61% plan to undertake a major transformation initiative over the same period.

The global EY CEO Imperative Study 2021 of 305 CEOs also found that within three years, 42% of respondents expect to make changes to their organisation’s risk management processes.

More than two-thirds of CEOs plan a major investment in data and technology over the next year

The Covid-19 pandemic has moved the longstanding CEO agenda item of digital-led business transformation from important to urgent. Many CEOs recognise the importance of human factors to the success of their transformation projects, with 68% of respondents saying they have at least one transformation priority related to the importance of people, the cultivation of future talent and organisational culture.

Ove Svejstrup, Associate Partner and leader of EY’s digital service offerings in the Channel Islands, told Channel Eye: “The past year has been trying for everyone and CEOs have had to make tough decisions by reviewing portfolios and projects to balance the long-term growth prospects against immediate shareholder expectations. Technology has been the common denominator for most organisation’s resilience amid the pandemic.”

Technology and automation will be crucial to unlocking new sources of value and efficiency

EY recently launched their FinTech in the Channel Islands survey to gauge the attitudes of Channel Islands business towards FinTech and related technology solutions and to analyse how Covid-19 has impacted the adoption levels of these technologies across the islands. A report of the findings will be released later this year.

“With the increased reliance on technology solutions to work remotely and stay connected, particularly over the past year, it is more important than ever before for businesses to ensure they have digital strategies and solutions implemented, which is reflected in this global survey. Through our Channel Islands FinTech survey it will be interesting to benchmark Channel Islands businesses against the commitments being made by CEOs across the globe to increase investment in data and technology.”

People centric transformation will be key for long term value

Over the next five years, 87% of respondents believe the creation of long-term value across stakeholders will be welcomed and rewarded by the market, while 91% of respondents believe new business models will increasingly incorporate aspects of the circular economy, making better use of natural resources and reducing waste.

Alongside this, 80% agree there is likely to be a global standard for measuring and reporting long-term value creation and 80% agree that their organisations will take significant new steps to take ESG responsibility inside their operations. However, analysis of responses against key long-term value dimensions such as societal, human, financial and customer, revealed an intention-action gap.

Ove explains what businesses in the Channel Islands need to be considering in the near future: “While the research highlights that CEOs are willing to transform, EY data found a clear gap between intention and execution, particularly when it comes to long-term value and ESG.

“Given the sense of urgency around these issues is only increasing, CEOs will come under greater regulatory and reputational pressure to operate differently. Leaders need to follow through their public commitments with action to demonstrate they are taking the bold steps needed to drive long-term value and change.”

Data trust gap potential threat for transformation

As data security and privacy regulations move to the forefront of public discourse, there remains a considerable trust gap between the capabilities of intelligence technologies and what people are willing to let these innovations do.

Only 34% of respondents affirm that customers trust them with their data, reinforcing the need for CEOs and the C-suite to scrutinize processes around data collection, management and use, while increasing transparency with customers and other stakeholders. If left unaddressed, this issue could limit growth, slow innovation and stall transformation efforts.

Despite this gap, 88% of respondents state that the use of data science to anticipate and fulfil individual customer needs will be a main differentiator in the next five years; while 87% of respondents say delivering data-driven experiences will drive competitive advantages during the same period. In the more immediate term, 41% of respondents believe artificial intelligence (AI) and data science requires increased attention from the C-suite over the next 12 months.

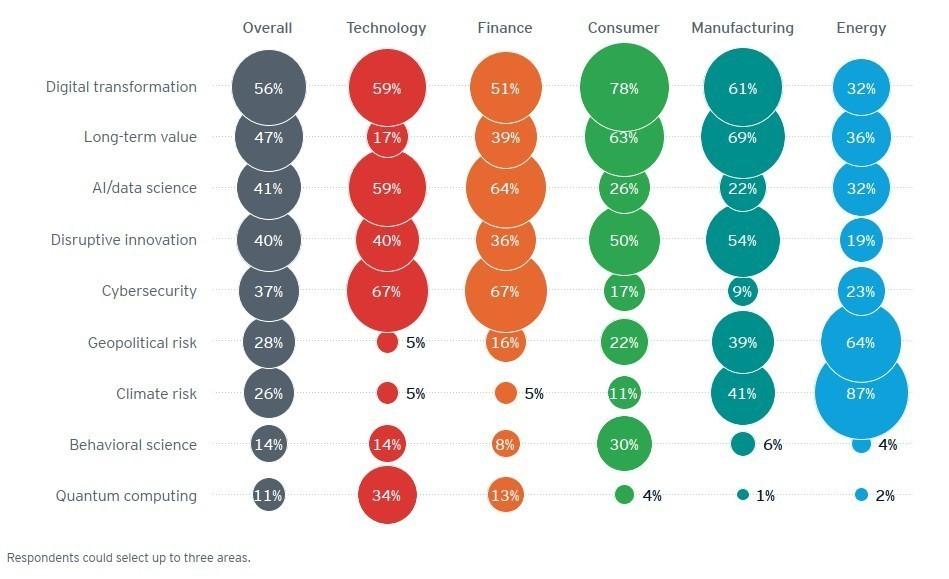

Areas of increased C-suite focus to drive growth

The trends driving company transformation are not new, but they are newly urgent. Digital-led transformation has topped the CEO agenda for years but has always been a challenge due to the continuously adapting nature of technology innovations. To keep up, transformation must be continuous.

Ove concluded: “Technology and automation will continue to unlock new sources of value and efficiency for financial services companies, as this diagram highlights. To continue to thrive, businesses in the Channel Islands will need to ensure they are not only placing their people at the centre of decision-making, but also adopting technology at speed and driving innovation at scale. Weaving these value drivers into every aspect of transformation will allow CEOs to drive long-term value creation and ultimately maximise growth potential.”